Colorado 1099-G: Maximize Your Tax Refund & Avoid Errors!

Are you puzzled by the arrival of a 1099-G form in your mailbox? Then, understanding the Colorado 1099-G tax refund is not just beneficial; it's essential for every individual who has received government payments or refunds during a tax year.

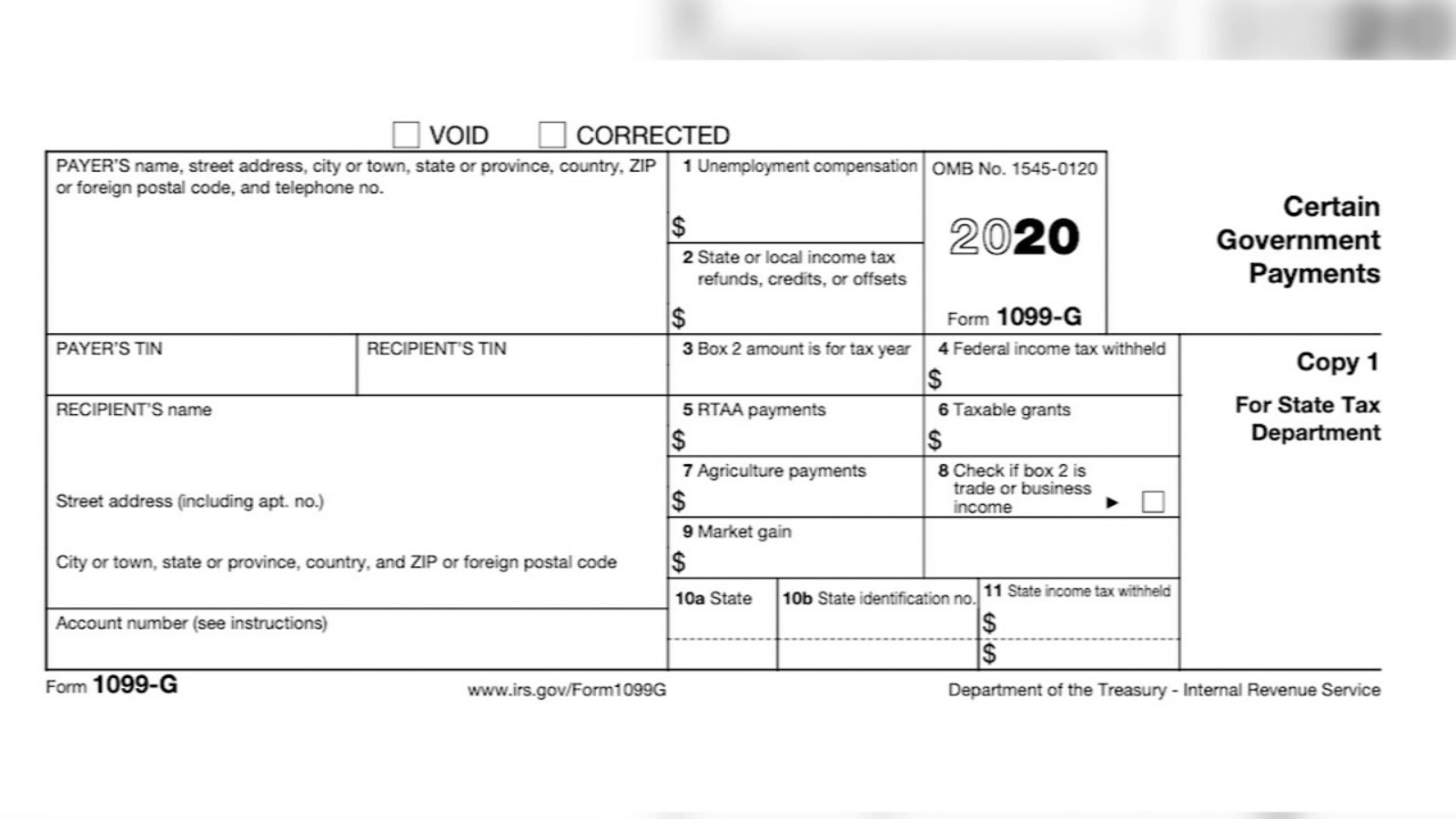

The world of taxation often presents a labyrinth of forms and regulations, and the 1099-G is no exception. Many taxpayers find themselves bewildered when this particular form appears, unsure of its purpose or how it impacts their tax obligations. The form serves as an IRS document, reporting certain government payments made to individuals during the tax year. These payments can include unemployment compensation, state or local tax refunds, and other government-related income. The form acts as a record of these payments for both the taxpayer and the IRS, ensuring accurate reporting during tax season. This article aims to demystify the Colorado 1099-G tax refund process, offering actionable insights and expert advice to navigate the complexities of tax filing with confidence. Whether you are a seasoned taxpayer or new to the process, this guide will be an invaluable resource for ensuring your tax returns are accurate and compliant with Colorado's tax laws.

| Tax Form | 1099-G (Certain Government Payments) |

| Issuing Agency (Colorado) | Colorado Department of Revenue |

| Purpose | To report specific government payments, including tax refunds and unemployment compensation. |

| Recipients | Individuals who received unemployment benefits, state or local tax refunds, or other government financial assistance. |

| Delivery Deadline | Typically mailed by January 31st of each year. |

| Tax Implications |

|

| Related Forms |

|

| Key Boxes |

|

| Key Action | Verify the accuracy of the form and include the information on your federal and state tax returns. |

| Reference Website | Colorado Department of Revenue |

Form 1099-G is an important document issued by the IRS to report specific government payments. These payments can encompass a variety of sources, including unemployment compensation, state or local tax refunds, and other forms of government assistance. For taxpayers, this form is the key to accurate tax reporting, ensuring that all government payments are accounted for. It helps avoid potential discrepancies with the IRS, guaranteeing that your tax return is a true and complete representation of your financial situation.

- Qvccom Your Ultimate Guide To Shopping Online In 2024

- Pie Agrave La Mode History Recipes Cultural Impact

The 1099-G form comprises several key components, each providing essential information. The most important of these are: Box 1, showing the total amount of government payments received during the tax year; Box 2, indicating state or local tax refunds that might be considered taxable income; and Box 3, reporting the amount of unemployment compensation received, which is typically taxable.

When it comes to the specifics of the Colorado 1099-G tax refund process, residents need to be aware of the states unique regulations and requirements. The Colorado Department of Revenue issues Form 1099-G to individuals who have received specific payments from the state. These payments can include tax refunds or unemployment benefits. Generally, these forms are distributed by January 31st of each year, providing ample time for taxpayers to prepare their tax returns.

Although the federal 1099-G form serves as a general template, Colorado has its own specific nuances that taxpayers must keep in mind. These include the possible need for additional documentation or forms depending on the nature of the payments received, and whether the state tax refund is taxable at the federal level, as this can affect their overall tax liability.

- Katmovie Tv Your Ultimate Guide To Streaming Movies Online

- Tiger Woods His Relationships Inside His Love Life Career Impact

Not every taxpayer receives a 1099-G form. This document is specifically issued to those who have received certain types of government payments during the tax year. Common recipients include individuals who received unemployment compensation, those who obtained a state or local tax refund, and individuals who were awarded government grants or other forms of financial assistance. It is important to understand that not all government payments are reported on Form 1099-G; for instance, Social Security benefits are reported on a different form, Form SSA-1099.

Once you have received Form 1099-G, understanding its role in your tax filing process is crucial. The information provided on this form must be reported accurately on both your federal and state tax returns to ensure you are in compliance with tax laws. The process involves verifying the information on the form, reporting the appropriate amounts on your federal tax return (Form 1040), and including the required details on your Colorado state tax return (Form DR 104).

For many people, receiving a tax refund is a welcome event. Understanding how refunds are calculated and issued helps in managing expectations and avoiding any surprises. In Colorado, tax refunds are usually issued after the state processes your tax return and confirms that you are owed money. Various factors influence the size of your tax refund, including the amount of taxes you paid throughout the year (through withholding or estimated payments), any deductions or credits you claim on your tax return, and any prior-year tax refunds that must be reported as income.

When dealing with Form 1099-G and tax refunds, it is easy to make mistakes that could lead to penalties or delays. Common errors include forgetting to report state tax refunds as income on your federal return, incorrectly calculating the taxable portion of unemployment compensation, and failing to verify the information on Form 1099-G. Remaining vigilant and carefully double-checking your work can minimize errors and ensure a smoother tax filing experience.

Filing your Colorado 1099-G tax refund involves several key steps. These include gathering essential documents, completing the appropriate forms, and submitting them by the deadline. Before beginning the filing process, make sure you have all the necessary documentation. This includes Form 1099-G, W-2 forms from employers, and your previous year's tax return. With this information, you can complete your federal and state tax returns, including any necessary adjustments or deductions based on the information from the 1099-G and other relevant documents.

Colorado provides numerous deductions and credits to help reduce your tax liability and potentially increase your refund. Some of the most frequently used include the Homestead Exemption, Child Tax Credit, and Earned Income Tax Credit (EITC). Exploring the credits and deductions you are eligible for can significantly impact your tax outcome, so taking the time to understand these possibilities is worthwhile.

Taxpayers looking for extra guidance can find several resources to help them understand and file Form 1099-G. These include the IRS Form 1099-G page and the Colorado Department of Revenue website. These resources offer detailed information and tools to ensure accurate and compliant tax filing.

- Kathleen Rosemary Triado The Rising Star Of Entertainment

- Luxmovies Fun Your Guide To Streaming Movies Online 2024

Colorado Tax Refund 2024 Status Ronni Cindelyn

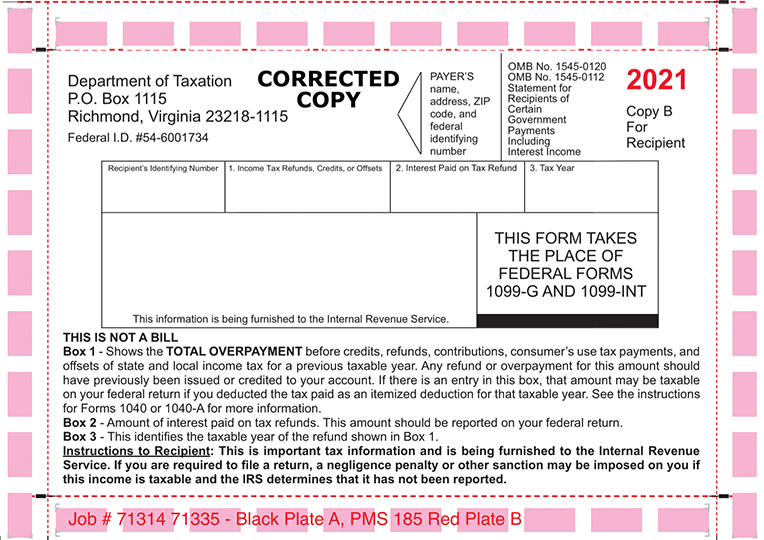

Important 1099G Update Virginia Tax

Il unemployment tax form 1099 g jerywee